All Categories

Featured

Table of Contents

- – How does Self-banking System create financial ...

- – How secure is my money with Self-banking System?

- – What financial goals can I achieve with Wealt...

- – What is the best way to integrate Infinite Ba...

- – How do I leverage Infinite Wealth Strategy t...

- – What happens if I stop using Infinite Bankin...

We utilize data-driven methods to examine monetary items and solutions - our evaluations and rankings are not affected by marketers. Unlimited banking has actually captured the interest of numerous in the individual financing globe, promising a path to financial flexibility and control.

Limitless financial describes a financial method where a specific becomes their own banker. This concept focuses on the use of whole life insurance policy policies that gather money value in time. The insurance holder can obtain against this money value for various monetary requirements, effectively lending money to themselves and paying off the policy by themselves terms.

This overfunding increases the development of the plan's money worth. The insurance policy holder can after that obtain against this cash worth for any type of objective, from financing a vehicle to purchasing property, and afterwards pay back the financing according to their very own routine. Infinite financial offers many benefits. Right here's a look at a few of them. Infinite Banking concept.

How does Self-banking System create financial independence?

Right here are the response to some concerns you could have. Is boundless financial legit? Yes, boundless banking is a legitimate technique. It involves making use of a whole life insurance coverage policy to develop an individual funding system. Nevertheless, its performance relies on different factors, consisting of the plan's structure, the insurance provider's efficiency and exactly how well the method is handled.

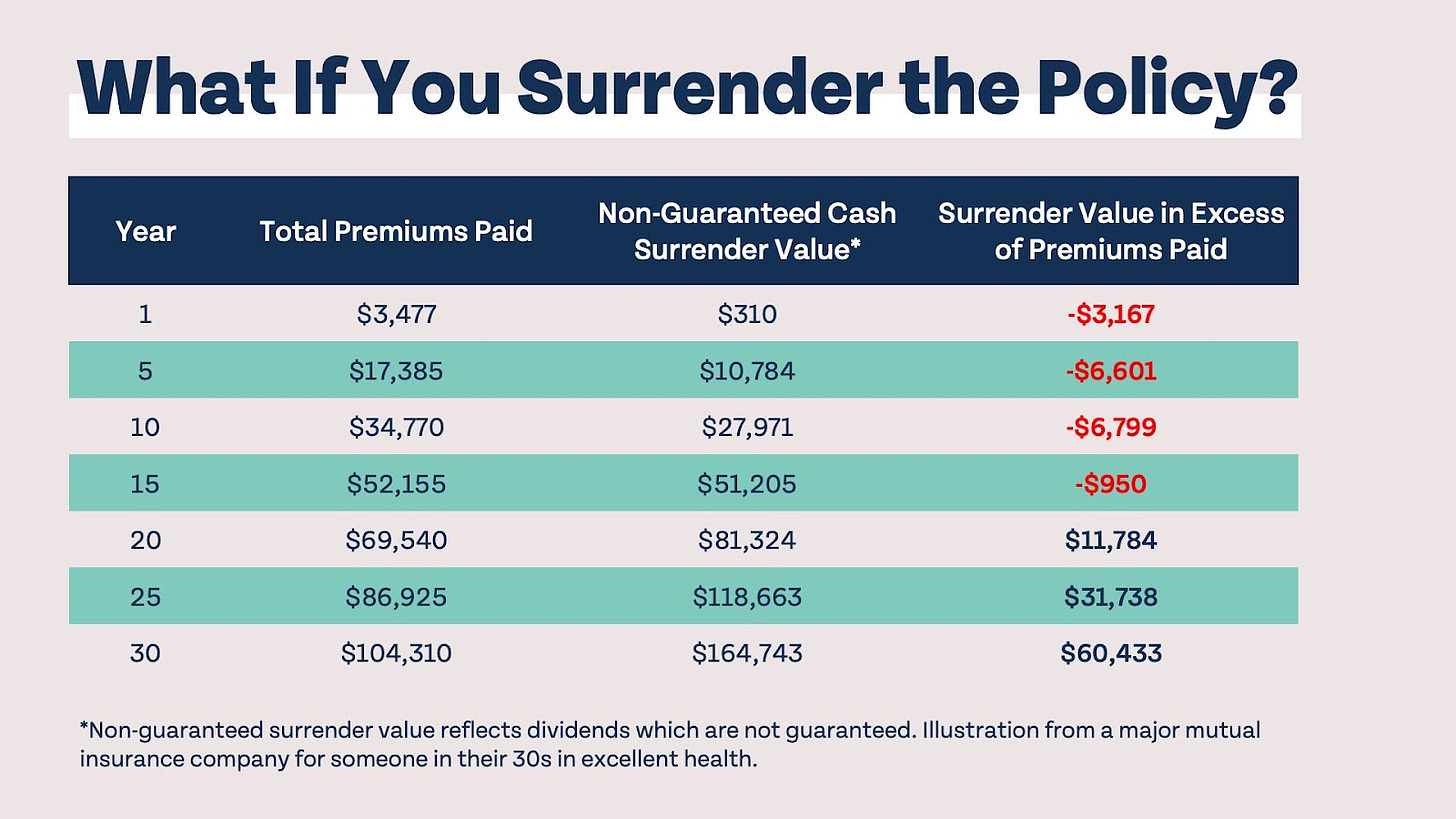

The length of time does infinite banking take? Boundless banking is a long-lasting method. It can take a number of years, frequently 5-10 years or even more, for the cash money value of the plan to expand completely to begin borrowing versus it effectively. This timeline can vary relying on the plan's terms, the premiums paid and the insurance provider's efficiency.

How secure is my money with Self-banking System?

So long as premiums are present, the insurance policy holder just calls the insurer and demands a funding against their equity. The insurance firm on the phone will not ask what the lending will certainly be utilized for, what the earnings of the debtor (i.e. insurance holder) is, what various other possessions the person might have to serve as collateral, or in what duration the person plans to repay the funding.

Unlike call life insurance coverage items, which cover just the beneficiaries of the insurance holder in the occasion of their fatality, entire life insurance covers an individual's whole life. When structured appropriately, whole life plans produce an one-of-a-kind revenue stream that raises the equity in the policy gradually. For additional analysis on just how this jobs (and on the pros and cons of entire life vs.

In today's globe, one driven by convenience of consumption, a lot of take for provided our country's purest beginning principles: flexibility and justice. Most individuals never think how the items of their bank fit in with these merits. So, we posture the easy question, "Do you really feel liberated or justified by operating within the restrictions of industrial credit lines?" Click here if you wish to find a Licensed IBC Expert in your area.

What financial goals can I achieve with Wealth Management With Infinite Banking?

Lower car loan rate of interest over policy than the traditional finance products obtain security from the wholesale insurance coverage's cash money or surrender value. It is an idea that enables the insurance policy holder to take loans overall life insurance plan. It should be available when there is a minute economic problem on the individual, wherein such car loans may help them cover the monetary tons.

The insurance policy holder needs to connect with the insurance policy business to request a funding on the plan. A Whole Life insurance policy can be labelled the insurance coverage item that gives security or covers the individual's life.

It starts when an individual takes up a Whole Life insurance policy. Such plans preserve their worths due to the fact that of their traditional approach, and such plans never ever invest in market tools. Limitless financial is a principle that allows the insurance policy holder to take up finances on the whole life insurance plan.

What is the best way to integrate Infinite Banking Benefits into my retirement strategy?

The cash or the abandonment value of the entire life insurance serves as security whenever taken car loans. Expect an individual enrolls for a Whole Life insurance policy with a premium-paying regard to 7 years and a policy duration of twenty years. The individual took the policy when he was 34 years of ages.

The collateral obtains from the wholesale insurance plan's money or abandonment value. These factors on either extreme of the range of truths are discussed below: Boundless banking as an economic advancement enhances cash flow or the liquidity account of the insurance holder.

How do I leverage Infinite Wealth Strategy to grow my wealth?

In economic dilemmas and challenges, one can make use of such products to make use of car loans, thus mitigating the trouble. It uses the most affordable money expense compared to the standard financing item. The insurance plan loan can likewise be available when the individual is out of work or dealing with wellness concerns. The Whole Life insurance policy plan preserves its overall value, and its efficiency does not relate to market efficiency.

Generally, acts well if one totally counts on financial institutions themselves. These ideas work for those who have strong economic capital. On top of that, one have to take just such plans when one is economically well off and can take care of the policies premiums. Unlimited financial is not a scam, yet it is the very best point many individuals can decide for to improve their financial lives.

What happens if I stop using Infinite Banking Vs Traditional Banking?

When individuals have infinite banking explained to them for the very first time it seems like an enchanting and safe method to expand riches - Infinite wealth strategy. The concept of replacing the disliked financial institution with borrowing from on your own makes a lot more sense. Yet it does require replacing the "disliked" bank for the "disliked" insurance business.

Of course insurance coverage firms and their representatives like the idea. They developed the sales pitch to sell even more entire life insurance coverage.

There are two severe financial calamities developed right into the limitless financial concept. I will reveal these defects as we function through the mathematics of just how infinite financial actually functions and how you can do a lot better.

Table of Contents

- – How does Self-banking System create financial ...

- – How secure is my money with Self-banking System?

- – What financial goals can I achieve with Wealt...

- – What is the best way to integrate Infinite Ba...

- – How do I leverage Infinite Wealth Strategy t...

- – What happens if I stop using Infinite Bankin...

Latest Posts

Infinite Banking Concepts

How Do I Start My Own Bank?

The Banking Concept

More

Latest Posts

Infinite Banking Concepts

How Do I Start My Own Bank?

The Banking Concept